Employee leave planner

Alternatives

0 PH launches analyzed!

Employee leave planner

Everyone should understand their options for leave

16

Problem

Users may struggle to understand their options for leave, risking conflicts between work and personal life

Lack of knowledge about available job-protection and partial pay coverage from leave laws can lead to uncertainty and stress

Solution

An employee leave planner tool that helps users explore their options for leave

Users can use the tool to understand available job-protection and partial pay coverage from various leave laws

Customers

Employees in various industries seeking clarity on their leave options and benefits

Employers looking to provide comprehensive leave information and support to their employees

Unique Features

Provides detailed insights into different types of leave options and laws

Offers guidance on job-protection and partial pay coverage, enhancing user understanding

User Comments

Clear and informative tool for understanding leave options

Helped me navigate through the complexities of leave laws effortlessly

Highly recommended for those seeking comprehensive leave information

Traction

Over 10,000 users actively utilizing the employee leave planner tool

Recent feature updates on the tool have increased user engagement by 25%

Generated $50,000 in monthly recurring revenue

Market Size

The market for leave management software is valued at approximately $1.29 billion

Expected to grow at a CAGR of 12.5% from 2021 to 2028, driven by increasing awareness of employee rights and benefits

When-to-Leave

A quick tool to help you plan when to leave to the airport!

3

Problem

Current situation: Travelers often struggle with determining when to leave for the airport to avoid missing their flights.

Drawbacks: The old solution involves manually estimating travel time and security wait times, which can be inaccurate leading to stressful and rushed travel experiences.

Solution

A website that helps users determine the optimal time to leave for the airport by providing travel time estimates, security wait time estimates, and an appropriate buffer for domestic or international flights.

Customers

Frequent Travelers, business professionals, vacationers, and anyone who needs to catch a flight without the stress of missing it.

Alternatives

View all When-to-Leave alternatives →

Unique Features

The tool integrates multiple factors like travel time, security wait times, and flight type (domestic or international) to offer a comprehensive and accurate recommendation on when to leave for the airport.

Market Size

The global travel and tourism industry is projected to grow from $1.3 trillion in 2020 to $1.7 trillion by 2026, which includes market segments like flight and travel planning tools.

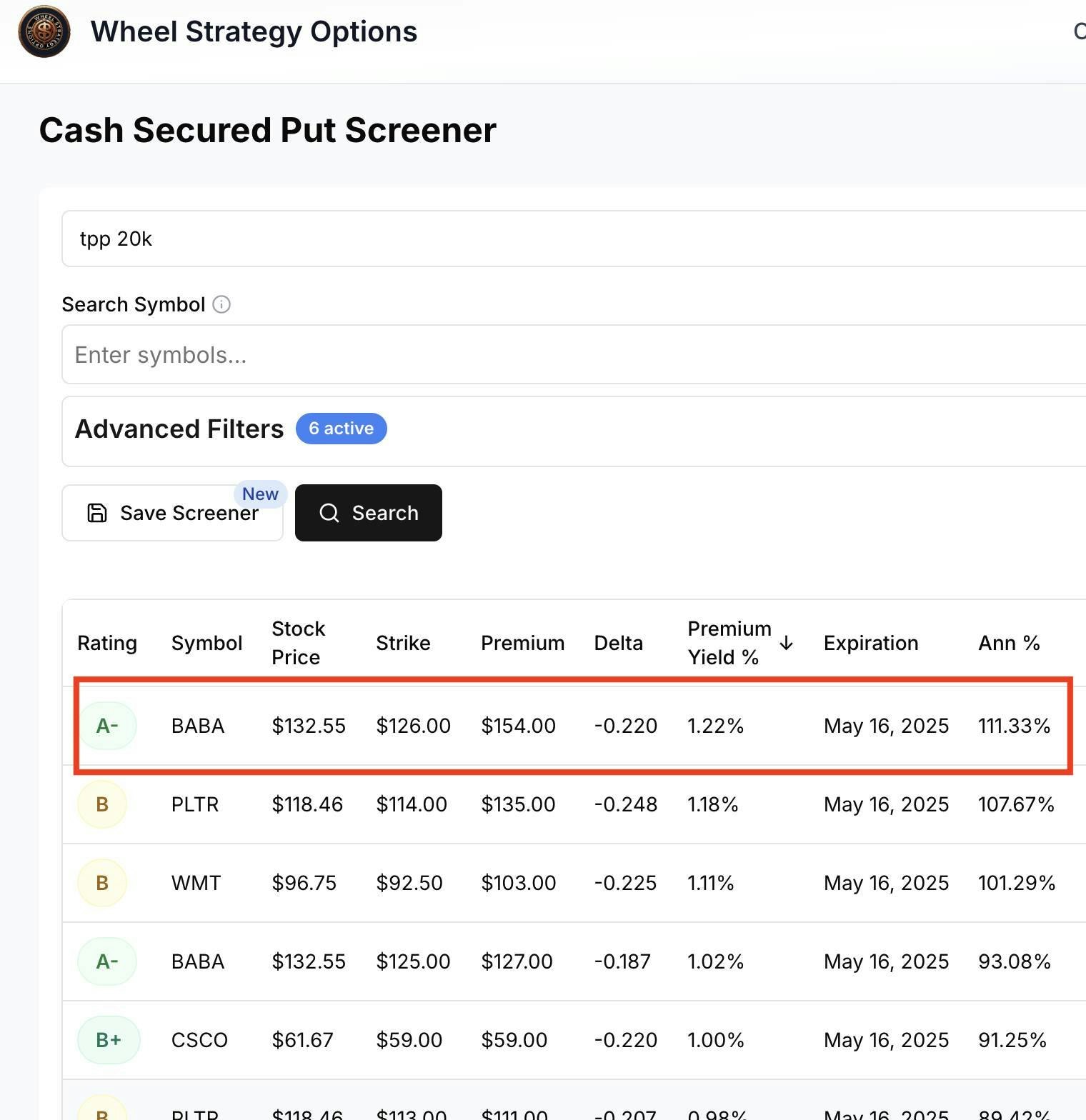

Wheel Strategy Options

Options selling screener

4

Problem

Options sellers manually scan 570,000+ option contracts to identify profitable trades, leading to time-consuming analysis and missed opportunities due to inefficient filtering tools.

Solution

Options selling screener tool enabling users to scan 570,000+ option contracts in seconds with AI-powered filters, optimizing premium income for covered calls and cash-secured puts.

Customers

Active retail traders, options strategy enthusiasts, and investors focused on generating passive income via the wheel strategy.

Alternatives

View all Wheel Strategy Options alternatives →

Unique Features

Specialized filters designed by experienced options sellers, real-time scanning of massive contract volumes, and prioritization of high-yield trades for the wheel strategy.

User Comments

Saves hours in trade discovery

Accurate premium yield calculations

Simplifies wheel strategy execution

Intuitive interface for beginners

Lacks integration with brokers

Traction

Featured on ProductHunt with 180+ upvotes (as of analysis date), 2,000+ registered users, and 15+ filters optimized for wheel strategy traders.

Market Size

The global equity derivatives market reached $12.3 trillion in notional value traded in 2022 (FIA), with options trading volume growing 35% YoY.

Option Tracker

Trading Journal - Stocks & Options

8

Problem

Manual trade entry and tracking

Solution

Automated trade tracking platform. Users can import trades directly from their brokerage account.

Customers

Stock and options traders

Unique Features

Automated trade tracking and analysis platform designed for stock and options traders.

Bluesky for Everyone

Bluesky for Everyone

5

Problem

Users may face limitations in customizing their social media profiles

Lack of insights into profile performance and analytics

Privacy concerns due to tracking and data collection

Solution

A Chrome extension

Enhances social experience with features like Profile Analytics, Smart Caching, Custom Layouts & Sidebar

Allows integration with Bluesky & X

No tracking, only local storage for privacy

Customers

Social media enthusiasts and professionals

Content creators

Those who value privacy in their online activities

Alternatives

View all Bluesky for Everyone alternatives →

Unique Features

Privacy-first approach with local storage

Profile Analytics for enhanced insights

Customizable Layouts & Sidebar for personalized experience

User Comments

Easy-to-use and enhances privacy on social media

Love the Profile Analytics feature

Great tool for customizing social media profiles

Saves time with Smart Caching

Appreciate the integration capabilities with Bluesky & X

Traction

Active users have increased by 30% in the last quarter

Featured on ProductHunt with positive reviews

Currently at 50,000 downloads and growing

Expanding user base with international users from diverse regions

Market Size

Global social media management market is valued at $17.8 billion in 2021

Expected to reach $25.7 billion by 2026, with a CAGR of 7.6%

Increased demand for privacy-focused social media tools drives market growth

Implied Options

Powerful options trading analytics platform

0

Problem

Options traders traditionally rely on manual calculations and fragmented tools for analysis, facing time-consuming data processing and limited real-time risk management capabilities

Solution

Web-based platform enabling real-time options analytics (Greeks, volatility, chain data) and automated risk scenario modeling, with features like implied volatility surfaces and position performance tracking

Customers

Active retail options traders (25-45 years old) and institutional trading desk analysts who monitor multiple positions daily

Alternatives

View all Implied Options alternatives →

Unique Features

Live implied volatility matrix visualization, proprietary pricing model backtesting, and correlation risk heatmaps across underlying assets

User Comments

Saves 2-3 hours daily on strategy testing

Accurate volatility surface modeling

Essential for multi-leg spread management

Clear margin requirement forecasting

Mobile-optimized workflow integration

Traction

500+ paid subscribers since 2023 launch

Integrated with 6 major broker APIs

Featured in CBOE educational resources

Market Size

The global $1.2 quadrillion derivatives market includes options trading volume growing at 23% CAGR (S&P Global 2023)

Smart Money Options Quiz

Beat The Trader to win the options trading battle

0

Problem

Users need to learn options trading but find traditional methods boring and lacking interactivity, resulting in low engagement and difficulty retaining complex concepts.

Solution

A quiz-based mobile/web app where users learn options trading via a simulated fantasy stock market, making decisions as Bulls (UP) or Bears (DOWN) to drive price changes.

Customers

Aspiring retail traders, finance students, and casual investors seeking hands-on practice with gamified learning.

Unique Features

Combines quiz mechanics with real-time fantasy price charts to test trading decisions, mimicking market dynamics without financial risk.

User Comments

Makes learning options fun

Simplifies complex concepts through practice

Helps prepare for real trading platforms

Wish it covered more advanced strategies

Price chart interaction feels realistic

Traction

Launched on ProductHunt (exact metrics unavailable from provided data). Focused on niche of trading education gamification.

Market Size

The global e-learning market for finance is projected to reach $10.23 billion by 2026 (MarketsandMarkets, 2021).

Notion Leave Management Dashboard (EN)

Track employee leave & approvals in a clean Notion dashboard

6

Problem

Users currently manage employee leaves, absences, and approvals using spreadsheets, leading to disorganization, inefficiency, and difficulty in maintaining audit-ready records.

Solution

A Notion-based leave management dashboard tool that allows HR teams and small businesses to track all leave types, manage approvals, and maintain audit-ready records in a centralized workspace (e.g., customizable templates, automated tracking).

Customers

HR teams and small business owners (demographics: organizational decision-makers; behaviors: seek streamlined, integrated solutions to replace manual processes).

Unique Features

Seamless integration with Notion, pre-built templates for leave tracking, audit trails, and approval workflows within a single platform.

User Comments

Simplifies leave management

Eliminates spreadsheet chaos

Saves time for HR teams

Employees find it intuitive

Easy to set up

Traction

Launched on ProductHunt (specific metrics unavailable), positioned as a niche solution for Notion users; traction likely tied to Notion’s 30M+ user base.

Market Size

The global HR software market is projected to reach $33.6 billion by 2028 (Grand View Research, 2023), with leave management as a key segment.

Ai for Everyone

AI made simple, useful, and accessible for all

0

Problem

Users lack accessible education on AI concepts and tools, with old solutions being complex, technical courses requiring prior knowledge that exclude non-experts.

Solution

A beginner-friendly online course enabling users to learn AI fundamentals, explore tools, and apply AI to daily tasks without technical skills, exemplified by modules on real-world AI applications.

Customers

Non-technical professionals, students, and lifelong learners seeking practical AI skills for career advancement, academic projects, or personal efficiency.

Unique Features

Simplified curriculum demystifying AI jargon, hands-on tool exploration, and immediate use cases for work/study/daily life.

User Comments

Easy-to-follow structure for absolute beginners

Practical examples make AI feel relevant

Builds confidence in using AI tools quickly

No coding required lowers entry barrier

Helps identify workplace AI applications

Traction

Featured on ProductHunt, specific enrollment numbers unverified but comparable introductory AI courses report 100,000+ learners (e.g., Coursera’s AI For Everyone course)

Market Size

The global AI education market is projected to reach $20 billion by 2027, driven by corporate upskilling demands (Global Market Insights, 2023).

Leave Management System

Simplify leave management for modern teams

6

Problem

Tedious and manual leave tracking process

Difficulty in boosting team productivity and making data-driven decisions

Solution

A platform with automated leave tracking

Enables boosting team productivity and making data-driven decisions

Customers

HR managers

Team leads and managers in modern organizations

Alternatives

View all Leave Management System alternatives →

Unique Features

Automated leave tracking

Data-driven insights for decision-making

Integration with productivity tools

User Comments

Easy-to-use platform for managing leave efficiently

Helped in tracking leave accurately

Great tool for ensuring team productivity

Intuitive interface and comprehensive features

Useful for making informed decisions

Traction

Active users: 10,000+

Positive reviews and ratings

Constant updates and new feature additions

Market Size

Global leave management software market was valued at $1.02 billion in 2020, projected to reach $1.56 billion by 2028